Top personalization trends in 2024: from AI to hyper-personalization

Personalization is no longer an option in the digital marketing world – it’s an essential strategy brands need to engage, attract, and keep customers loyal. With customer expectations constantly evolving, staying ahead of emerging trends is important in creating positive customer experiences.

In this blog post, we will explore the top personalization trends that will define the future of digital marketing in 2024. From artificial intelligence (AI) advancements to hyper-personalization and dynamic content, we’ll delve into the strategies that will help brands engage, attract, and keep customers loyal.

Artificial intelligence (AI)

Personalization has become more advanced thanks to artificial intelligence (AI). With its ability to go through huge amounts of data and find meaningful patterns, AI helps deliver content that’s tailored just for your customers. By using machine learning, these algorithms can continuously improve and adapt to your user’s preferences. This results in highly relevant product recommendations, custom content, and promotions that are designed to captivate customers.

Dotdigital’s AI-driven product recommendations, for example, help pinpoint the products customers are most likely to be interested in. Our seven pre-built product recommendation categories — best sellers, trending, most viewed, lookalikes, best next, also bought, and custom category — cater to different stages of the customer journey.

Each category is designed to strategically target customers with personalized product options that match their preferences. When you offer customers products that genuinely pique their interest, you’re not only increasing the likelihood of a sale but also making their shopping experience a breeze. It’s a win-win situation for both you and the customer – they find what they’re looking for, and you achieve a successful sale.

Predictive analytics

By 2024, predictive analytics is expected to become essential for businesses seeking a competitive edge in understanding customer behavior. Digital marketers can utilize AI-driven predictive analytics to identify what customers are likely to do next.

At Dotdigital, we are dedicated to utilizing the potential of AI-driven predictive analytics to help digital marketers achieve their objectives. Our predictive analytics capabilities focus on four key areas: churn probability, predicted next purchase date, predicted customer lifetime value, and predicted total future orders. With Dotdigital’s predictive analytics capabilities, you can build customer segments based on these predictive metrics. What’s more, you can leverage the anticipated next purchase date to fine-tune your campaigns, ensuring they are tailored to your customers’ unique spending habits.

Hyper-personalization

Another trend for 2024 is hyper-personalization, which takes personalization to the next level by combining data from various sources such as behavioral, demographic, and transactional information. This comprehensive approach to personalization helps you gain a complete understanding of your customers, delve deeper into their preferences, and create messaging and offers that cater to their individual needs and desires.

Dotdigital has dynamic partner-built app blocks that allow you to personalize content and create engaging campaigns in just a few minutes. With no coding required, you can easily drag and drop third-party partner content into your emails and landing pages using EasyEditor. This helps you make the most of your existing martech stack while also reducing the number of customers who unsubscribe.

Today’s customers expect better experiences from the brands they choose to spend their money with. They prioritize quality over quantity and won’t hesitate to take their business elsewhere if they feel they’re not getting value from a brand. With our App Blocks, you can provide each customer with a better experience in every interaction.

Dynamic content

Looking ahead to 2024, dynamic content will play a significant role in personalizing email marketing. By utilizing customer data, such as their location, you can easily tailor your content and provide localized offers that engage your audience.

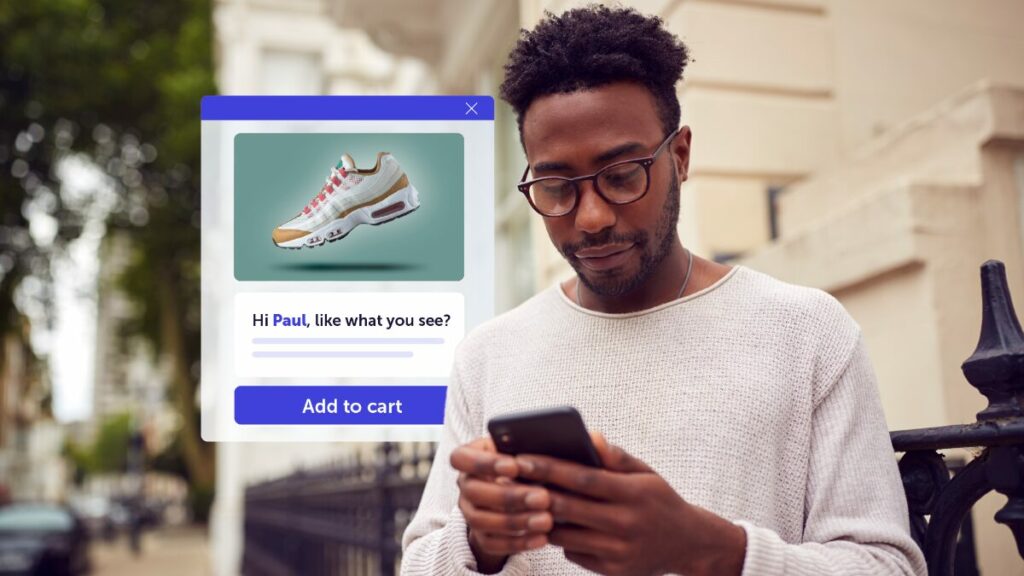

Imagine being able to address each recipient by their first name, showcase products they’re interested in, and highlight nearby in-store events. With the advancements in technology, personalizing your marketing communication has become a seamless process. You no longer need to create multiple campaigns for each version or individual recipient.

To achieve this, you can use data fields in your campaign creation to ensure each email feels unique to each customer. This method fills the content with information that is specific to each recipient, adding a personal touch to your email copy. As your audience interacts with your digital content, it adapts and becomes more tailored to their preferences, creating an effortless, personalized experience.

Personalizing your content with dynamic blocks allows you to reach your audience on a deeper level without spending countless hours manually crafting individual emails. Ultimately, you can elevate your email marketing by sending multiple variations of a single email, each rendered uniquely through the power of dynamic content.

Summary

The future of digital marketing lies in personalization. Customers crave tailored experiences, and marketers must embrace trends such as AI personalization, predictive analytics, hyper-personalization, and dynamic content to meet these expectations. Staying updated with these trends and leveraging advanced marketing solutions like Dotdigital will enable you to create effective and impactful campaigns that truly connect with your audience.